The Indian investment landscape is evolving rapidly, and one of the latest developments from SEBI is the introduction of Specialized Investment Funds (SIFs). These funds are designed to cater to high-net-worth individuals and accredited investors seeking sophisticated investment avenues. With this new asset class, there comes a regulatory and knowledge framework that professionals must adhere to. This is where the NISM-Series-XIII: Common Derivatives Certification Examination becomes critical.

What are Specialized Investment Funds (SIFs)?

SIFs are innovative investment schemes aimed at bridging the gap between traditional mutual funds and portfolio management services. They allow mutual fund houses to create more flexible and dynamic products using strategies like long-short positions across asset classes.

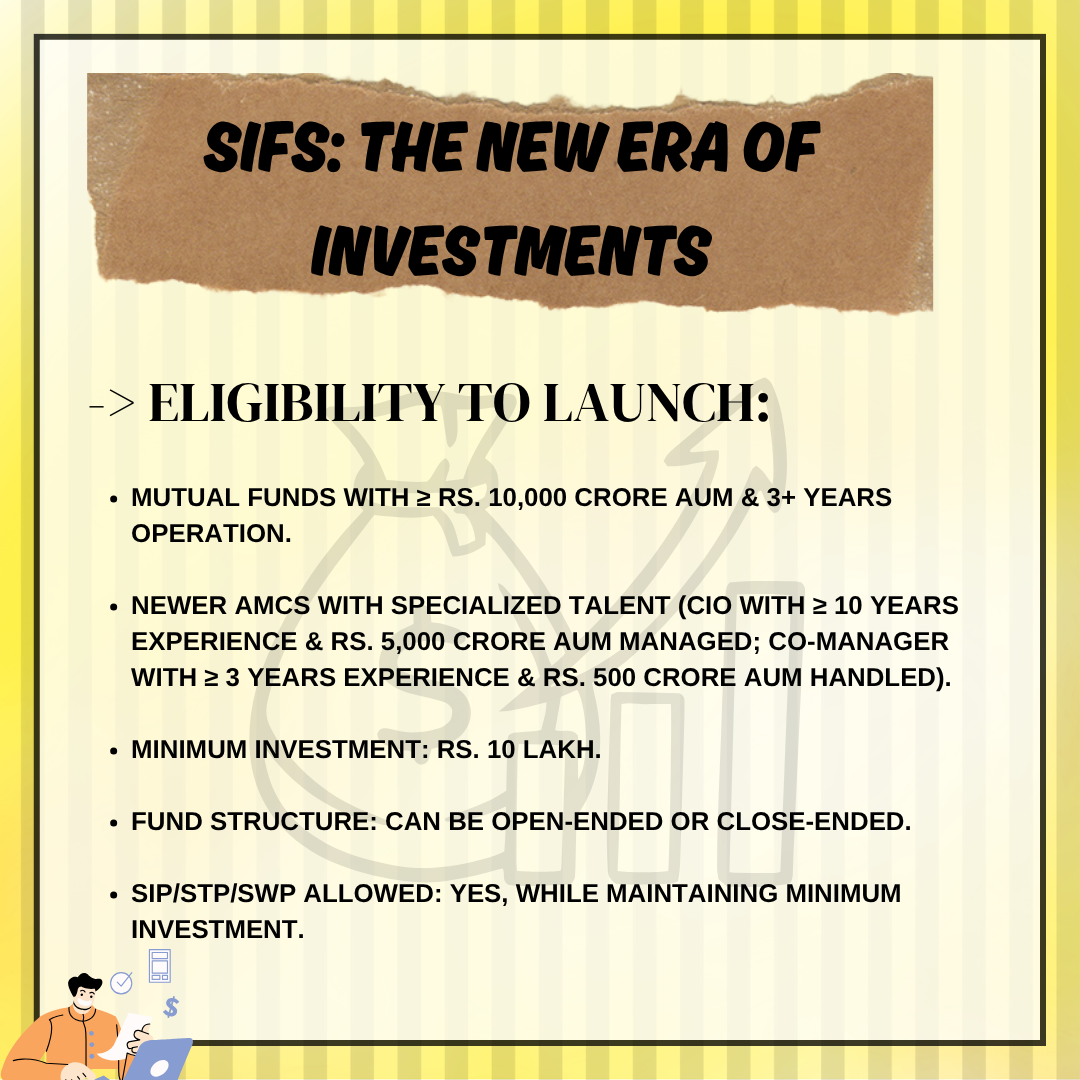

Eligibility to Launch: Mutual funds with at least Rs. 10,000 crore AUM and 3+ years of operation.

Minimum Investment: Rs. 10 lakh.

Fund Structure: Can be open-ended or close-ended.

SIP/STP/SWP Allowed: Yes, subject to maintaining minimum investment.

CIO must have 10+ years of experience and managed Rs. 5,000 crore AUM.

Co-manager must have 3+ years experience and Rs. 500 crore AUM handled.

These funds can invest in equities, bonds, unhedged securities, and even derivatives, offering significant flexibility and diversification.

Why is NISM-Series-XIII Certification Important?

With the launch of SIFs, SEBI has mandated that Mutual Fund Distributors (MFDs) must hold the NISM-Series-XIII: Common Derivatives Certification to distribute these products. This examination is designed to ensure that individuals involved in the derivatives market have the required knowledge and expertise.

About the NISM-Series-XIII Exam:

Combined Curriculum: Covers Equity, Currency, and Interest Rate Derivatives.

Mutual Fund Distributors selling SIFs

Sales personnel and approved users of trading members

Anyone seeking to understand or work in the derivatives market

Assessment: 150 marks exam assessing comprehensive understanding of derivatives.

This certification ensures a standardized level of knowledge among professionals dealing with SIFs and enhances investor protection.

As SEBI opens doors to more complex and rewarding investment opportunities through SIFs, it's crucial that market participants upskill to stay relevant. The NISM-Series-XIII certification is not just a regulatory checkbox but a testament to your expertise in the evolving world of derivatives. Mutual Fund Distributors and financial advisors must take this opportunity seriously to remain compliant and competent in this competitive landscape.

Investors are looking for informed and certified professionals to guide them through these sophisticated products. Let your certification be your credibility.