There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Thu Jan 29, 2026

The urgent need for professionalisation through certifications such as NISM Series XIII is best illustrated by the current state of retail participation in the Indian derivatives market. SEBI has recently released updated studies that describe a "financial massacre" in the retail F&O segment, highlighting a massive disconnect between the perceived ease of trading and the actual outcomes for individual investors.

The SEBI Report on F&O Losses:

A study covering the period from FY22 to FY24 revealed that a staggering 93% of individual F&O traders incurred losses. The aggregate losses exceeded ₹1.8 lakh crore over these three years, with individual traders spending an average of ₹26,000 annually on transaction costs alone. Even more concerning is the demographic profile: 43% of these traders were under the age of 30, many of whom were "YOLO-ing" on small trades and blowing up their entire capital base.

The report found that while individuals lost over ₹61,000 crore in FY24, institutional players like FPIs and proprietary trading desks booked massive profits. This disparity is largely attributed to the use of sophisticated algorithms and a deep understanding of market risk—exactly the knowledge areas covered by the NISM Series XIII curriculum. For a retail investor, trading F&O without professional training is likened to "bringing a spoon to a gunfight".

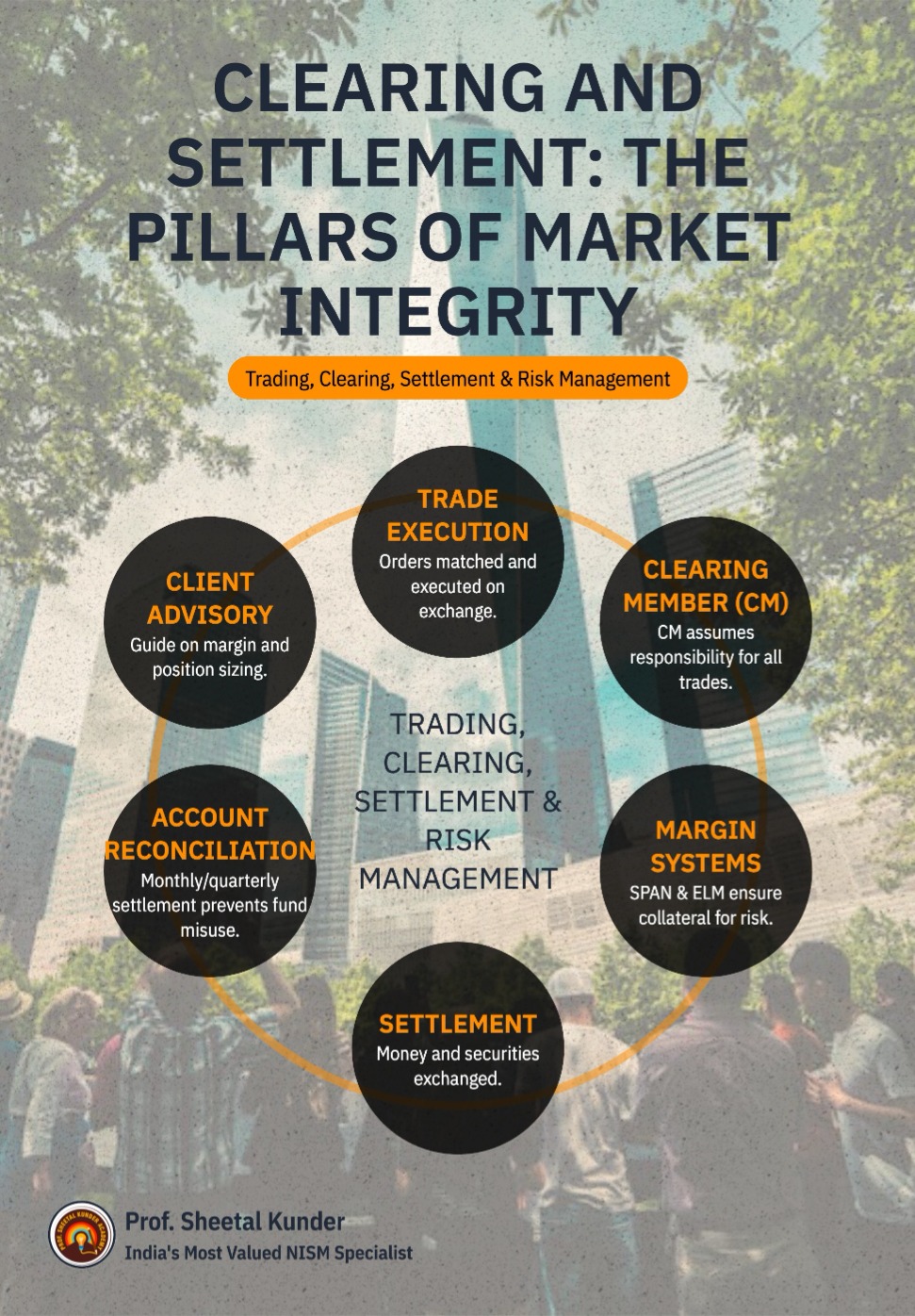

Clearing and Settlement: The Pillars of Market Integrity

One of the most critical modules in the Series XIII exam (17% weightage) is "Trading, Clearing, Settlement & Risk Management". Understanding this "plumbing" is essential for professionals to help clients avoid the "death by a thousand cuts" caused by transaction costs and slippage.

The clearing process involves the "Clearing Member" (CM) taking accountability for the positions of all trading members and clients clearing through them. The "Standard Portfolio Analysis of Risk" (SPAN) system is used to calculate initial margins, ensuring that the exchange has enough collateral to cover potential losses. Furthermore, SEBI has recently introduced "Extreme Loss Margins" (ELM) and mandatory monthly/quarterly settlement of running accounts to prevent brokers from misusing client funds. A professional who understands these mechanisms can advise clients on "Margin Management" and "Position Sizing," which are the primary reasons why most retail traders fail.

Strategic Preparation for the Series XIII Exam

Given the high stakes and the difficulty of the exam, experts like Prof. Sheetal Kunder and Shreyas Karade emphasise a structured preparation roadmap. The 3-hour "150-question challenge" requires not just knowledge, but mental stamina and time management.

Expert Roadmap to First-Attempt Success:

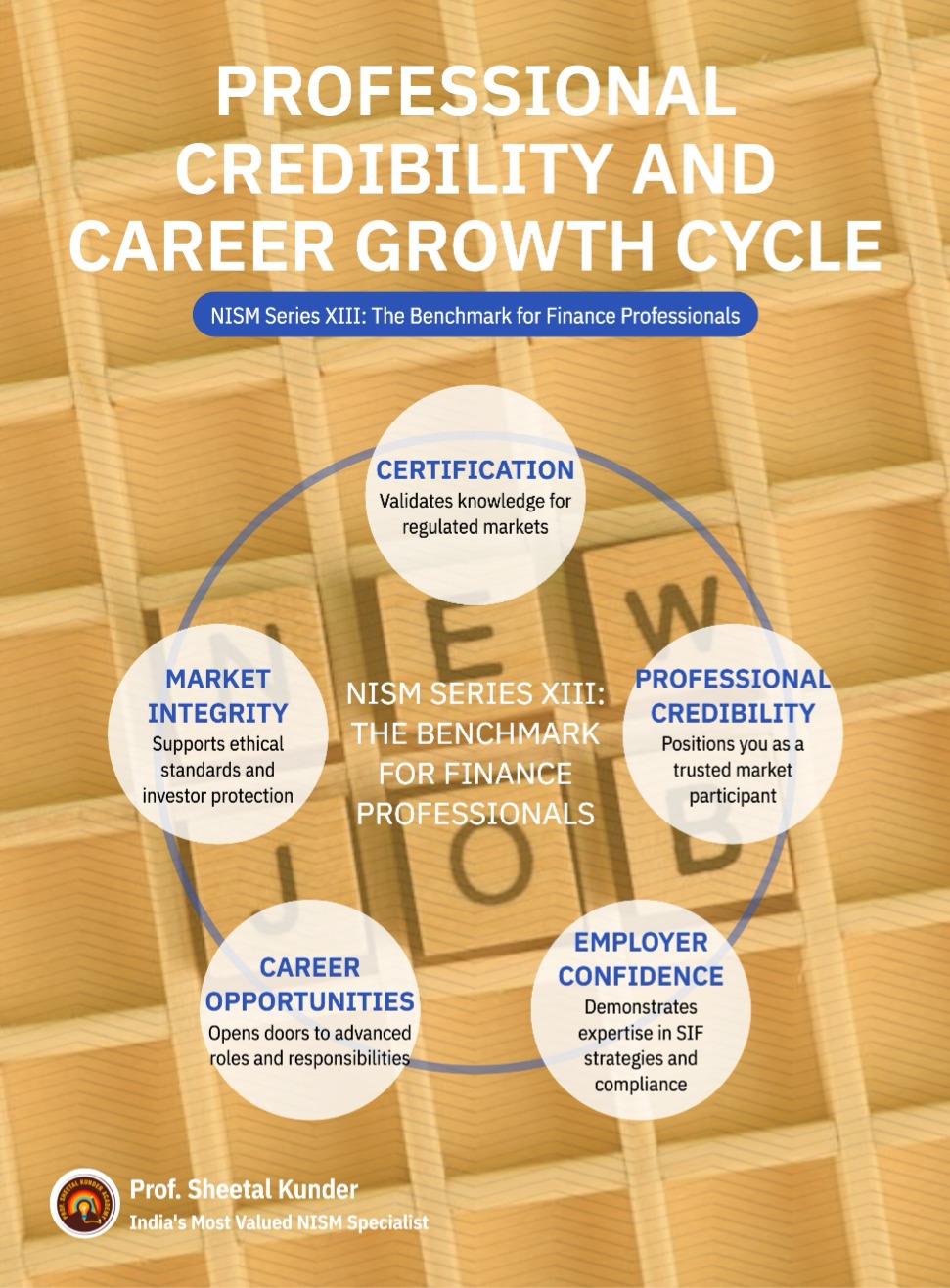

Professional Credibility and Career Growth

Ultimately, passing the NISM Series XIII exam is about more than just satisfying a regulatory requirement; it is about building professional credibility in a market that despises "single-skill specialists". A professional who can navigate the complexities of SIF strategies while explaining the regulatory protections offered by SEBI and RBI stands apart in the competitive landscape of Indian finance.

The certification validates that the individual has the "minimum knowledge benchmark" to protect investor interests and maintain market integrity. In an environment where 93% of traders lose money, the role of the educated, ethical, and certified professional is the only sustainable path forward for the Indian derivatives market. Whether working on a treasury desk, advising an HNI on SIFs, or managing risk at a broking firm, the NISM Series XIII credential remains the gold standard for career supercharging in 2025 and beyond.

Synthesised Conclusions on the Regulatory and Investment Landscape

The NISM Series XIII certification is now the foundational prerequisite for the Specialised Investment Fund (SIF) ecosystem. This is SEBI's strategic response to two needs: promoting professional-grade risk management in a speculative retail F&O environment and offering sophisticated, tax-efficient investment vehicles for high-net-worth individuals (HNIs).

For professionals, proficiency across equity, currency, and interest rate derivatives is the mandatory baseline. The SIF framework, with an entry barrier of ₹10 lakh, is designed for alpha generation and capital preservation. By mandating the Series XIII certification, SEBI ensures the "gatekeepers" of SIFs are qualified. The value of this credential is expected to increase as the market moves toward a projected SIF AUM of ₹1 lakh crore by 2028.

Prof. Sheetal Kunder

SEBI® Research Analyst. Registration No. INH000013800 M.Com, M.Phil, B.Ed, PGDFM, Teaching Diploma (in Accounting & Finance) from Cambridge International Examination, UK. Various NISM Certification Holders. Ex-BSE Institute Faculty. 18 years of extensive experience in Accounting & Finance. Faculty Development Programs and Management Development Programs at the PAN India level to create awareness about the emerging trends in the Indian Capital Market, and counsel hundreds of students in career choices in the finance area