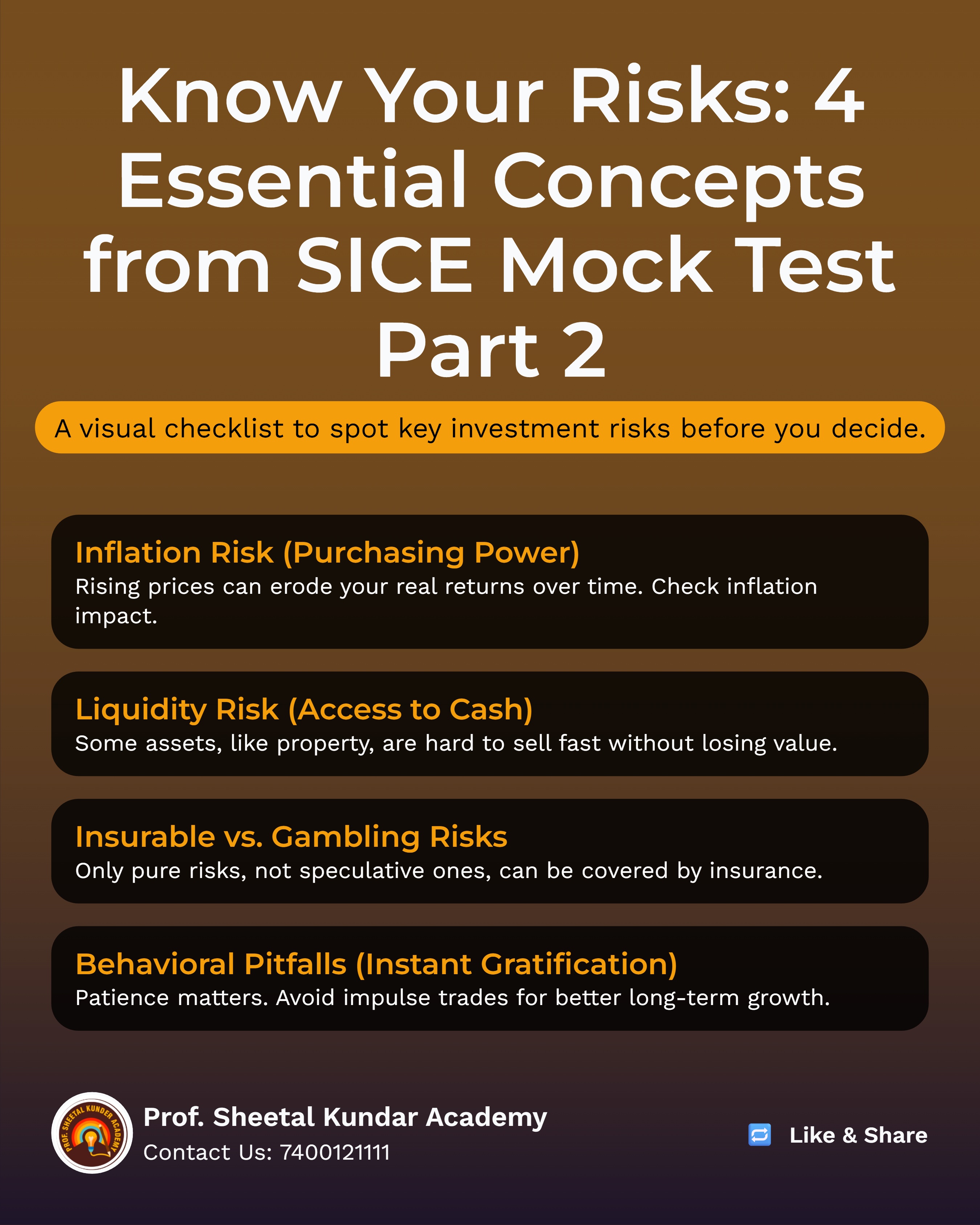

Q1. What is inflation?

- Correct answer: Rise in the general price level of goods and services.

- Explanation: Inflation erodes purchasing power; lower portfolio real returns delay or shrink corpus growth.

- Exam cue: Always compare nominal returns to inflation for real return.

Q2. Which risk cannot be insured?

- Correct answer: Losses from gambling.

- Explanation: Insurable risks are fortuitous and measurable (e.g., accidents, earthquakes, floods); speculative acts like gambling are not insurable.

- Exam cue: Speculative risk ≠ insurable risk.

Q3. If regular expenses exceed regular income, what should one do?

- Correct answer: Either borrow or sell assets.

- Explanation: First cut discretionary spends, but if essential outflows exceed inflows, bridge via prudent borrowing or asset sales.

- Exam cue: Align cash flow via budget; consider cost of borrowing vs asset liquidation.

Q4. Strategy to reduce investment risk by investing across avenues

- Correct answer: Diversification.

- Explanation: Spread across asset classes and within them to lower concentration risk and stabilize outcomes.

- Exam cue: “All eggs in one basket” = concentration risk.

Q5. Liquidity risk can be managed by

- Correct answer: Mapping cash flow needs to investment tenures.

- Explanation: Time goals decide product choice; short‑term needs use liquid/short duration products, long‑term can use growth assets.

- Exam cue: Horizon–product fit reduces forced exits.

Q6. Ability to convert investments into cash with ease is called

- Correct answer: Liquidity.

- Explanation: Listed equities/ETFs/MFs are relatively liquid; real estate is typically illiquid.

- Exam cue: Liquidity = speed + fair price realization.

Q7. At which life stage do longer life span and inflation pose high financial risk?

- Correct answer: Retirement.

- Explanation: Active income stops while expenses continue; plan a corpus that beats inflation for decades.

- Exam cue: Sequence‑of‑returns risk + longevity risk matter post‑retirement.

Q8. You often miss flights but do not buy insurance—this is

- Correct answer: Risk retention.

- Explanation: By not transferring (insuring) the risk, the financial impact remains with the traveler.

- Exam cue: Transfer via insurance vs retention by choice.

Q9. Know the time horizon; how to estimate annual rate to double money?

- Correct answer: Rule of 72 (72 ÷ years).

- Explanation: A thumb rule for compounding; for precise planning, use exact CAGR math.

- Exam cue: Handy for quick feasibility checks.

Q10. Market with strong demand and rising stock prices

- Correct answer: Bull market.

- Explanation: Rising sales/profits fuel optimism and higher equity prices.

- Exam cue: Bull = rising, Bear = falling.

Q11. Role of Depository Participant (DP) in securities market

- Correct answer: Safeguards and maintains securities in electronic form.

- Explanation: DPs interface between investors and depositories (NSDL/CDSL) for demat and transfers.

- Exam cue: DP = agent of depository for investor services.

Q12. During due diligence, an investor should consider

- Correct answer: Examining cash flow statement, income statement, and balance sheet.

- Explanation: Also evaluate business model, competition, management quality, and macro sensitivity.

- Exam cue: Avoid ignoring business model or peer comparisons.

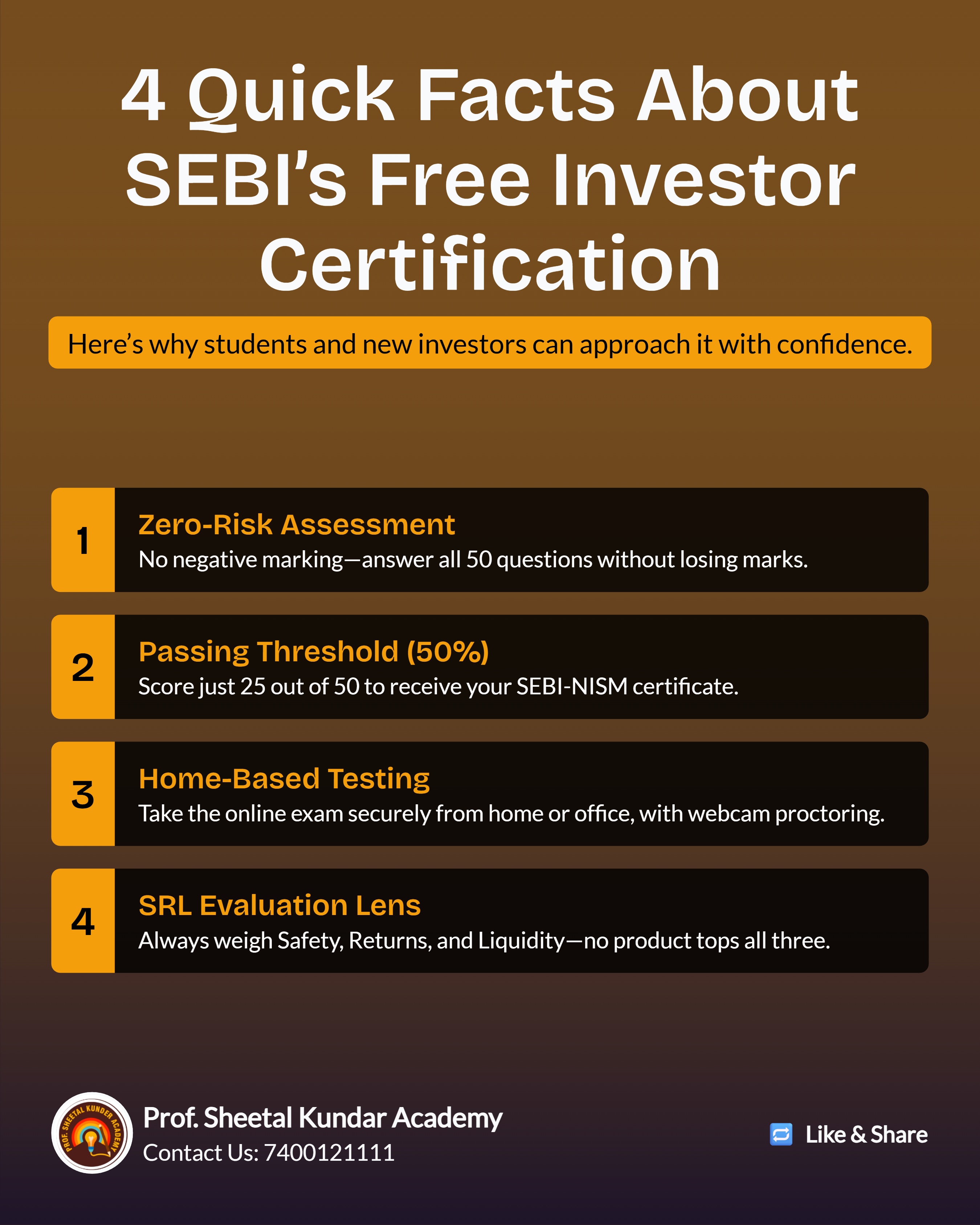

Q13. What is SEBI SCORES?

- Correct answer: An online platform for investors to file complaints against SEBI‑registered intermediaries and track resolution status.

- Explanation: Ensures time‑bound handling, status visibility, and escalation if needed.

- Exam cue: Use official grievance mechanisms for redressal.

Q14. When a market index value goes up, what does it imply?

- Correct answer: Investors are feeling positive about the market.

- Explanation: Index gains reflect weighted advances in constituent stocks, signaling improving sentiment.

- Exam cue: Index is an aggregate signal, not a guarantee for each stock.

Q15. Hybrid funds typically invest in

- Correct answer: A combination of equity and debt securities.

- Explanation: Asset mix manages risk/return; sub‑types vary by equity allocation.

- Exam cue: Check scheme category and Riskometer for fit.

Q16. Where can investors buy and sell REIT units?

- Correct answer: On the stock exchange.

- Explanation: Listed REITs trade like shares/ETFs during market hours, enabling liquidity.

- Exam cue: REIT income = rentals + potential appreciation.

Q17. Confirmation of trades done during the day for/on behalf of a client is called

- Correct answer: Contract note.

- Explanation: Shows order details, price, time, charges; statutory proof for trades.

- Exam cue: Verify promptly for accuracy.

Q18. Are derivatives low‑risk or high‑risk products?

- Correct answer: High risk.

- Explanation: Leverage, margining, and path‑dependence can amplify losses; requires strong risk controls.

- Exam cue: Options/futures demand clear strategies and limits.

Q19. Before investing, an investor should be aware of

- Correct answer: The risks involved.

- Explanation: Understand downside, volatility, liquidity, and suitability before expected returns or branding.

- Exam cue: Suitability first; returns later.

Q20. What is not traded on stock exchanges?

- Correct answer: Fixed deposits.

- Explanation: ETF units, listed company shares, and many debentures are exchange‑traded; bank FDs are not.

- Exam cue: Distinguish primary bank products vs marketable securities.

Q21. Main advantage of ETFs over regular mutual funds

- Correct answer: Higher daily liquidity and lower fees.

- Explanation: ETFs trade intra‑day and usually carry lower expense ratios than many active funds.

- Exam cue: Track index; mind tracking error and bid‑ask spreads.

Q22. IPO tip claims shares will double on listing—what should you do?

- Correct answer: Do your own homework; check fundamentals before investing.

- Explanation: Avoid tip‑driven decisions; assess business quality, valuations, risk.

- Exam cue: Hype ≠ investment thesis.

Q23. A pool of investments is called

- Correct answer: Mutual fund.

- Explanation: AMCs pool investor money into schemes for professional management per stated objectives.

- Exam cue: Read scheme documents for mandate and risks.

Q24. What returns do equity mutual funds offer?

- Correct answer: Dividends and capital appreciation.

- Explanation: NAV gains and distributed dividends form total return; taxation differs by component.

- Exam cue: Focus on long‑term, post‑tax, real returns.

Q25. From where can you buy securities of listed companies?

- Correct answer: Stock brokers (members of stock exchanges).

- Explanation: Registered trading members route orders to exchanges and handle settlement.

- Exam cue: Always transact via registered intermediaries.

Q26. What does a mutual fund’s NAV represent?

- Correct answer: Realizable value of the assets of the fund (per unit, net of liabilities/expenses).

- Explanation: NAV ≈ per‑unit market value after expenses; it updates per valuation norms.

- Exam cue: NAV is not “cheap/expensive” by itself—look at portfolio, not price alone.

Q27. Settlement of funds and securities as per running account authorization should occur

- Correct answer: At least once in 30 days or 90 days as opted by the investor.

- Explanation: Periodic settlement ensures idle balances are returned and accounts reconciled.

- Exam cue: Choose frequency and monitor statements.

Q28. Typical outcome for remaining investors when a Ponzi scheme collapses

- Correct answer: The promoter disappears with all the money.

- Explanation: Schemes pay old investors from new inflows until inflows stop and collapse occurs.

- Exam cue: “High return, no risk, hurry” = red flags.

Q29. Which is an objective of SEBI?

- Correct answer: Regulating the securities market.

- Explanation: SEBI regulates markets and protects investors; use its mechanisms for redressal and transparency.

- Exam cue: Know regulator roles and escalation paths.

Q30. You receive an email claiming a ₹1 crore lottery asking for personal and bank credentials—this is

- Correct answer: Phishing.

- Explanation: Never share credentials; report and delete suspicious communications.

- Exam cue: Use official portals; enable 2FA and strong hygiene.

Q31. Passive mutual funds are designed to

- Correct answer: Provide returns similar to the market index.

- Explanation: They replicate index constituents/weights; slight variance is tracking error.

- Exam cue: Costs and tracking error shape net results.

Q32. Investing all savings only in stocks is the only way to get rich—correct?

- Correct answer: No; diversify and explore other avenues too.

- Explanation: Asset allocation across equity, debt, gold, etc., balances risk and goals.

- Exam cue: Allocation > selection for long‑term outcomes.

Q33. Inherited 10,000 large‑cap shares; registrar not transferring despite attempts—what recourse?

- Correct answer: File a complaint on SEBI’s SCORES platform.

- Explanation: Official redressal provides tracking and timelines; RTA must respond.

- Exam cue: Maintain documentation for transmission requests.

Q34. Missed encashing dividends from FY15–16; can the company pay now?

- Correct answer: No; after 7 years, unclaimed amounts move to IEPF—recover via IEPF claim.

- Explanation: Unclaimed dividends and shares are transferred to IEPF; investors must claim from IEPF.

- Exam cue: Track dividends/corporate actions; update bank/KYC promptly.

Q35. Markets are rapidly falling—should long‑term investments be sold?

- Correct answer: No; avoid panic selling if fundamentals are intact.

- Explanation: Volatile phases like pandemics can reverse; focus on quality and horizon, not fear.

- Exam cue: Time in market and discipline drive compounding.

Q36. Newly‑listed company shows quick gains; news and social posts look positive—hold purely on news?

- Correct answer: No; do your own research beyond media/social narratives.

- Explanation: Momentum can reverse; assess fundamentals, valuations, and risks before decisions.

- Exam cue: Validate tips; use documented thesis and exit rules.